Finance keynote speaker

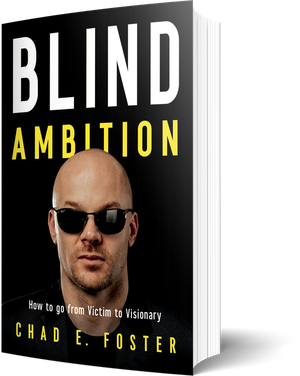

As the finance sector deals with change and disruption like never before, it’s crucial to hire the right keynote speaker. Leaders from a number of world-class companies in this sector have benefited by having Chad E. Foster as a keynote speaker.

Between the recent global pandemic, the breathtaking speed of technology disruption, and a wave of agile fintech startups, finance organizations have faced no shortage of disruption to traditional business models.

Mobile Banking

Consumers have been depending less on brick-and-mortar for several years. And with the explosion of smartphones and apps, they’re shifting towards mobile payments using their smartphones, foregoing credit card plastic in favor of simpler, touchless mobile payment services. Not only does this provide less expensive 24x7 banking, it also affords insights into consumer lifestyles and behaviors that can be used to offer new products while also reducing fraud.

This digital preference underscores the need to get the digital customer experience right. Making the technology easy to use is table stakes, but where finance organizations can differentiate themselves is by making it extremely personalized based on each consumer and their preferences – not just their customer segment.

Mobile banking also brings new competition for traditional players. Large tech companies such as Apple and Amazon, smaller fintechs, and even telecommunications providers are using their mobile connection with consumers to disintermediate traditional players. This presents challenges for maintaining the relationship, understanding patterns due to a lack of data, and running a business using less predictable customer behaviors.

Public Cloud, AI, and Blockchain

Finance organizations have been migrating to the cloud in pursuit of scalability, security, and resilience. The ease and velocity at which companies can start a project in the cloud compel many organizations to ditch traditional on-premises environments in favor of public, often multi-cloud infrastructures – where more than one public cloud provider is used across the entire estate.

Traditionally an early adopter of new tools, finance organizations have embraced artificial intelligence (AI) and machine learning (ML) to help with risk assessment and fraud prevention. With IDC forecasting financial services spending on AI/ML to account for nearly 14% of the $204 billion spent annually by 2025 – the second most spending on AI across all industries.

Analysts also predict that another growth area for AI will be in fair treatment of credit applicants, so everyone has fair access to lending and business funding.

And we cannot talk about technology in the finance sector without mentioning blockchain. Although cryptocurrencies have received much of the hype, the underlying blockchain technology is poised to redefine how these companies do business.

While the finance sector has relied on a centralized model for clearing transactions – think payment processing, regulation, and national banks – the distributed nature of blockchain technology will present significant challenges as companies and regulators rethink how to incorporate the benefits of blockchain into their businesses without losing the ability to affect monetary policy.

To be sure, the benefits cannot be ignored. Reducing fraud and waste, accelerating transaction processing times, and enhancing security, all while streamlining infrastructure are all just too compelling to ignore.

Case in Point

HSBC and Wells Fargo are using blockchain technology to settle foreign exchange trades. Mastercard, PayPal, and JPMC allow cryptocurrency payments on their networks, where JPMC even created its own cryptocurrency.

Finance Keynote Testimonials

"We were fortunate to have Chad present at our sales rally this year and the feedback was outstanding. His message and alignment with our theme was spot-on. He held our teams attention from start to finish. His pre-call work really paid big dividends."

- First Citizens Bank

Financial Services Keynote Speaker

Every industry is being pushed into change, in some cases faster than they prefer. Few industries have seen the pace of change that the financial services industry has dealt with. In his finance-oriented keynote addresses, Chad shares with audiences how to embrace the rapid pace of change in this industry with humor and excitement while discussing the unique technological challenges facing the industry, proven techniques on how to embrace change and make it work for your business, and the significant opportunities that have come about from the disruption of rapid change.

Keynote Programs

Explore our programs to see which one can help your organization create a

culture that unleashes leadership potential to maximize individual and

company performance.

Inquire About Speaking

Business Keynote Speaker

Identifying a keynote speaker with corporate experience is important as audiences face an onslaught of challenges. As a Keynote speaker and business leader, Chad E. Foster has extensive experience leading corporate teams and speaking at events and conventions for a number of leading companies in the corporate arena, including Google and Salesforce.

Industries throughout the world are experiencing unprecedented disruption due to a number of factors. Digital transformation is affecting all sectors of the economy, and the recent global pandemic has reshaped how we transact, go to market, and work – even how we live our daily lives.

Given the velocity of change and its impact on commerce, it has never been more important to improve our ability to adapt to changes, shift our mindset, and reinvent ourselves and our businesses.

Adapt and Thrive Amid the Uncertainty

Reinventing oneself and one’s organization takes a combination of factors. But one thing we know for sure, having the right tools/technology is not enough. In order for organizations to navigate these uncertainties, it takes an alignment of technology, processes, and people.

Creating a Resilient Culture

So, how can you create a culture that prepares your people to deal with the onslaught of changes coming at them? Empowering associates to thrive in change isn’t easy but it’s not impossible either.

It starts with creating a culture that’s prepared to turn obstacles into opportunities so you can take advantage of your disadvantages. So how can we take advantage of our disadvantages?

Case in Point

One such example in the business world may be found in the retail sector. In 2012 Best Buy was facing intense pricing pressure from online retailers when its new CEO, Hubert Joly, decided to look at its portfolio of brick-and-mortar stores with a fresh set of eyes. Instead of viewing them as a liability, he chose to use them as assets in an innovative business redesign that created the stores-within-a-store model where supply chain partners would invest in retail point of sale storefronts to enhance product and sales expertise for their products, leading to higher customer satisfaction, reduced cost for suppliers, and reduced cost for Best Buy through supplier investments. The company also started using these storefronts as distribution centers in order to beat online retailer delivery times. Had the company thought about its network of stores as just a liability, it would’ve never been able to reimagine its future and take advantage of its disadvantages.

Unlocking your organization’s possibilities starts with influencing the mindset of every individual in your organization, so you can leverage the collective potential of each person. The power lies in having an organization of forward thinkers who can reimagine ways of doing business in a differentiated way.

Individual Mindset and Company Culture

We know that Our mindset affects the language we use and the actions we take. Knowing that holds true for each individual, the collective behaviors of our organization are affected by the way each individual thinks and acts.

So, if we want a resilient company culture, we need a workforce made up of resilient individuals, which is why it’s so crucial to influence how each person in your organization thinks about navigating change, turning obstacles into opportunities, and reaching their full potential – so your business can reach its full potential.